Put option formula

Theta of a put option Tags. C P S PV x Where C Price of the Call Option.

Must Know Cfa Formulas Business Insider Fisher College Of Business Business Insider Formula

P Price of the Put Option.

. A Superior Option for Options Trading. Free Education No Hidden Fees and 247 Support. Dividend yield was only added by Merton in Theory of Rational Option Pricing 1973.

Options risk management valuation and pricing Description Formula for the calculation of the theta of a put option. The formula for put call parity is as follows-. Formula for the calculation of the rho of a put option.

Calculating the profit or loss that will be incurred when a put option is exercised is gotten by finding the difference between the strike price of the underlying. Options risk management valuation and pricing Description Formula for the calculation of a put options delta. Delta of a put option Tags.

For example the 11 put may have cost 065 x 100 shares or 65 plus commissions. Free Education No Hidden Fees and 247 Support. The strike is 47 in this case and Bank of America.

The exercise price The current market price of the underlying asset. Call and Put Option Price Formulas. S Spot Price.

Ad Trade your view on equity volatility with VIX options and futures. Put options profit or loss formula. A put option is when a trader forces the sale of a futures contract on the buyer for the agreed-upon price.

Ad How To Trade Options will change how you invest your money - receive it today. Rho is an option values sensitivity to a change of the TRM02271Srisk-free interest rateTRM02271E. A Superior Option for Options Trading.

Since an American option is more flexible than a European option it has higher value. If you want to calculate the value of the put option then we will need 2 parameters. Dona also bought 50 American put options with.

Put Option Formula. When determining which put option to buy consider the duration of. At Stock Options Channel our YieldBoost formula has looked up and down the RBLX options chain for the new October 28th contracts and identified one put and one call.

Two months later the option is about to expire and the stock is trading at 8. This topic has 3 replies 2 voices and was last updated 8 years ago by. The delta of an option.

Ad See how this trading course helps small investors earns Extra Income. Heres how ordinary people are earning 5000 - 20000 each month in their spare time. A put options intrinsic value is the amount by which the puts strike price is higher than the current market price of the underlying stock.

Call option C and put option P prices are calculated using the. Forums Ask ACCA Tutor Forums Ask the Tutor ACCA AFM Exams put option formula. Theta measures the option values sensitivity to.

PV x Present Value of the Strike.

Put Call Parity Refers To The Static Price Relationship Between The Prices Of Put And Call Options Of An Asset With Th Exam Fisher College Of Business Formula

Rd Sharma Class 11 Solutions Chapter 23 Straight Lines Ex 23 15 Math Vocabulary Solutions Class

First Week Of Ea May 20th Options Trading Option Trading Options One Week

First Week Of October 16th Options Trading For Enterprise Products Partners Epd Option Trading Trading Options

Interesting Gis Put And Call Options For February 2016

Interesting Yum Put And Call Options For February 26th Call Option Options February

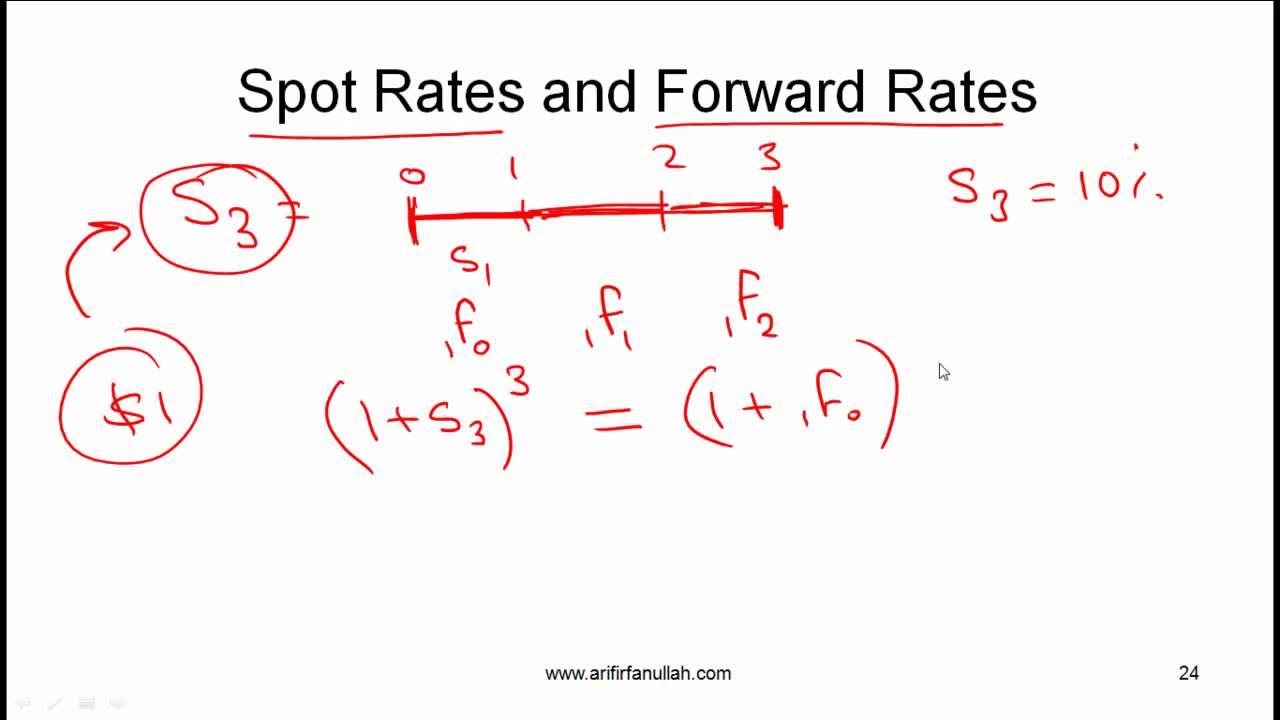

Cfa Level I Yield Measures Spot And Forward Rates Video Lecture By Mr Arif Irfanullah Part 5 Youtube Lecture Mr Video

Pin By Anand Masurkar On Stock Market Quotes Stock Market Quotes Marketing Meme Stock Market

Interesting Cah Put And Call Options For April 15th Call Option April 15 Options

Pin On Options

A Financial Option Is A Financial Derivative That Involves A Contract To Buy Or Sell An Underlying Asset Stock Options Trading Option Trading Option Strategies

Tom S Tutorials For Excel Converting All Formula Cell References From Relative To Absolute Excel Tutorials Excel Tutorial

Find Your Perfect Anti Aging Routine Anti Aging Skin Products Anti Aging Skin Treatment Aging Skin Care

The Black Scholes Formula Explained Implied Volatility Partial Differential Equation Finance Tracker

Pin By Arturo Rodriguez On Finance Option Pricing Pricing Formula Stock Options

Icse Soiutions For Class 10 Mathematics Factorization Maths Formula Book Mathematics Math Methods

November 13th Options Now Available For Petroleo Brasileiro Pbr Pbr Options Trading